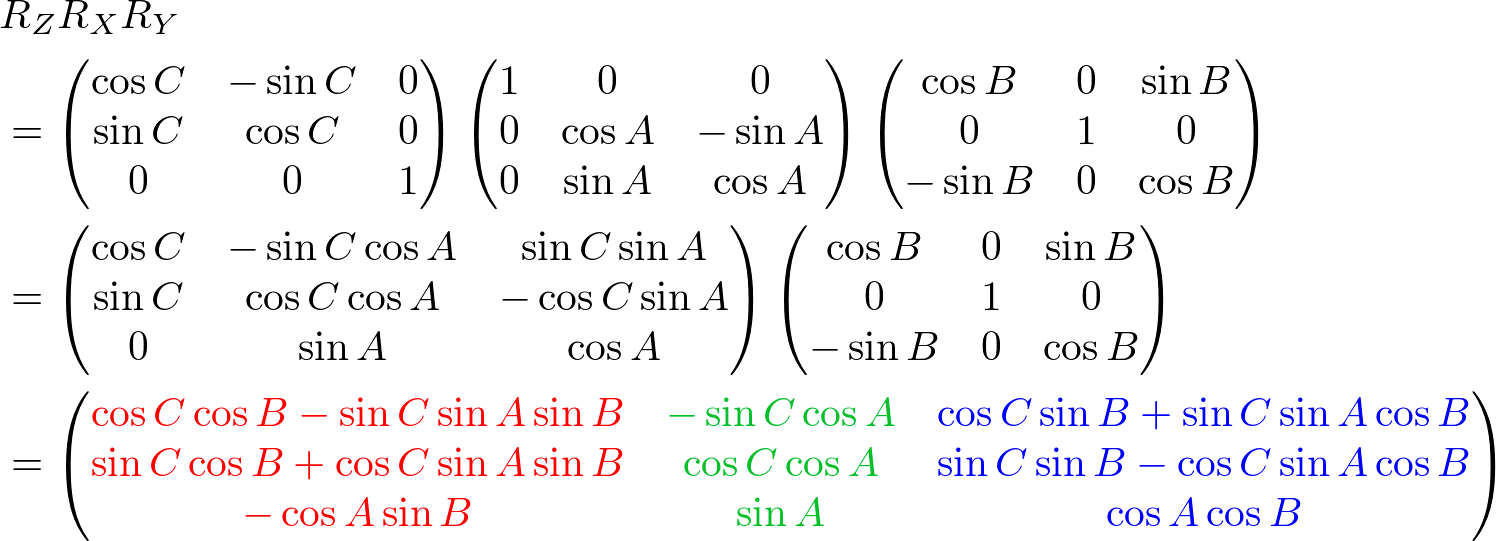

But with decent macro and trade management skills, that might be enough to extract edge. Even with a lot of work placed into it, it is still likely that the trader will be only performing with 60% of rotation recognition at best. The only way to develop objective trend rotation reading skills is to include both failing and successful rotations as determined by trader, before the market shows the result. On the other hand, consider the matrix that rotates the coordinate system through a counterclockwise angle. Then (1) so (2) This is the convention used by the Wolfram Language command RotationMatrix theta. For this purpose, we work in an orthogonal Cartesian system in angstroms: conversion. Rotation Matrices Rotation Vectors Modified Rodrigues Parameters Euler Angles The following operations on rotations are supported: Application on vectors Rotation Composition Rotation Inversion Rotation Indexing Indexing within a rotation is supported since multiple rotation transforms can be stored within a single Rotation instance. In, consider the matrix that rotates a given vector by a counterclockwise angle in a fixed coordinate system. That is why if a trader wants to develop some decent trend following skills, the methods of reasoning have to be tested and practiced in the live market before the rotation happens, and then tracking/noting the actual results in how many cases a trader was on right or wrong side (however backtesting and hindsight analysis is as well important, as that is where ideas are formed). vector by a rotation matrix R and addition of a translation vector t. In hindsight, those are easy to define because often traders will find any reason to justify rotation, even if that reason over repetition of 100 samples does not show consistent performance. This corresponds to the following quaternion (in scalar-last format): > r R.fromquat( 0, 0, np.sin(np.pi/4), np.cos(np. Consider a counter-clockwise rotation of 90 degrees about the z-axis. For example, traders that use indicators will point out that indicator showed reversal trend signal, and price action traders might point to certain high or low that signaled the rotation, and so on. The underlying object is independent of the representation used for initialization. 2022.Īll rights reserved.In hindsight, often trader will find where the trend rotated and extrapolate or over-fit the reason that triggered the trend rotation. If there are two matrices of same size, containing same elements with same frequency, is it always possible to change one matrix to other by rotating any. Works well with distinct clusters withoutĬrawford-Ferguson kappa = (m-1) / (p+m-2).

Matrix< 4, 4 >, rotate (const float radians, const float3 &axis).Rather than look at the vector, let us look at its x and y components and rotate them (counterclockwise) by. To rotate counterclockwise about the origin, multiply the vertex matrix by the given matrix. Use the following rules to rotate the figure for a specified rotation. Each factor tends to have either large or small loadings on a particular variable making it easy to identify each variable with a single factor. Matrix provides a utility class for small-dimension floating-point matrices. In this we have proposed a new replacement algorithmic rule for Digital encoding called as Binary Matrix Rotations Technique (BMR) which reduces size of the. The rotation matrix can be derived geometrically. A rotation maps every point of a preimage to an image rotated about a center point, usually the origin, using a rotation matrix. Smaller kappa minimizes variables complexity and larger kappa minimizes factor A computational faster equivalent to CF-Varimax.

P = number of variables, m = number of factors.

0 kommentar(er)

0 kommentar(er)